Rupee Slide and Stricter Visa Rules Force Indian Students to Rework Overseas Education Plans

Indian families are facing a tougher calculus when it comes to plans for higher education abroad as the Indian rupee weakens and global visa regimes tighten, according to industry and banking data....

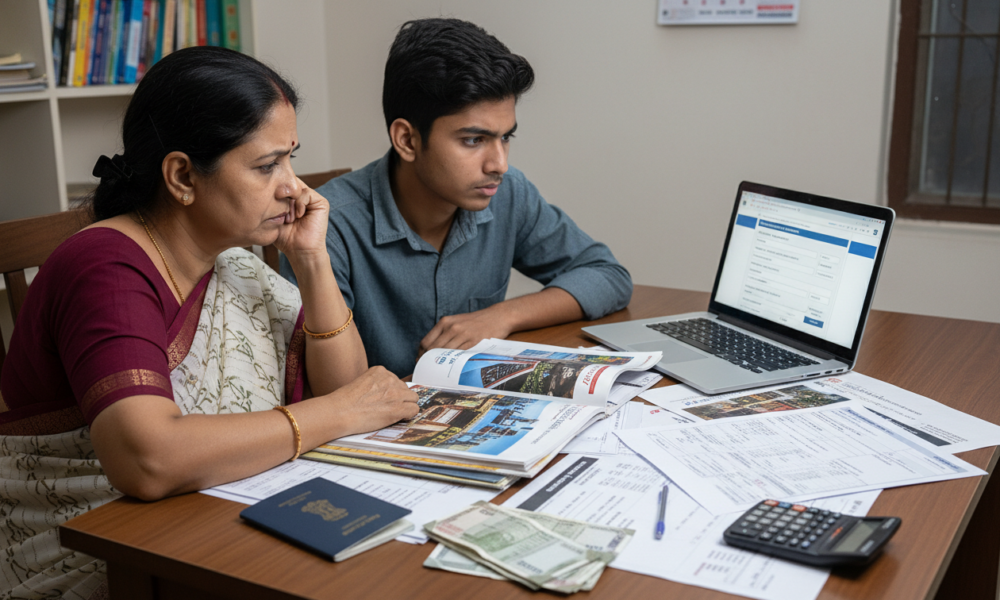

Indian families are facing a tougher calculus when it comes to plans for higher education abroad as the Indian rupee weakens and global visa regimes tighten, according to industry and banking data. The combination is eroding affordability and prompting many prospective students and their families to review choices of destination, funding and timing.

Recent data from the Reserve Bank of India shows a sharp decline in remittances for overseas education. Outward flows under the Liberalised Remittance Scheme tagged for education fell more than 23 per cent year-on-year in August 2025, suggesting families are reassessing the costs of study abroad in the face of currency pressures and visa uncertainties.

The slide in the rupee’s value against major currencies has increased the local cost of foreign degrees. What once was a manageable expense is now considerably higher for Indian households. For example, total expenses for a four-year undergraduate degree have increased significantly in rupee terms compared with previous years.

Alongside the economic challenge, visa regimes in prominent destination countries have grown less predictable. Canada’s rejection rate on student visa applications for Indian applicants climbed to around 74 per cent in recent months, up from roughly 32 per cent two years earlier. The United States recorded its highest rejection rate in a decade for F-1 student visas, with increased scrutiny on both student and work categories.

Changes in the United Kingdom’s immigration rules have shortened post-study work periods and raised financial requirements for dependents, adding further strain on prospective students seeking long-term opportunities abroad.

As savings come under pressure, education loans are playing a bigger role in financing international study. Lenders report that the average size of sanctioned education loans has risen in recent years, reflecting the additional burden placed on families. Experts say further depreciation of the rupee could increase borrowing costs and stretch family finances.

The shift is driving some students to explore alternative destinations with transparent visa policies or lower overall costs. As a result, choices for overseas education are being recalibrated in light of both global policy changes and evolving economic realities.

No Comment! Be the first one.